Should you buy a house right now? It’s May, we are still amongst a health pandemic that has sent our economy into a state of shock. I mean, there is no other way to describe it – shock.

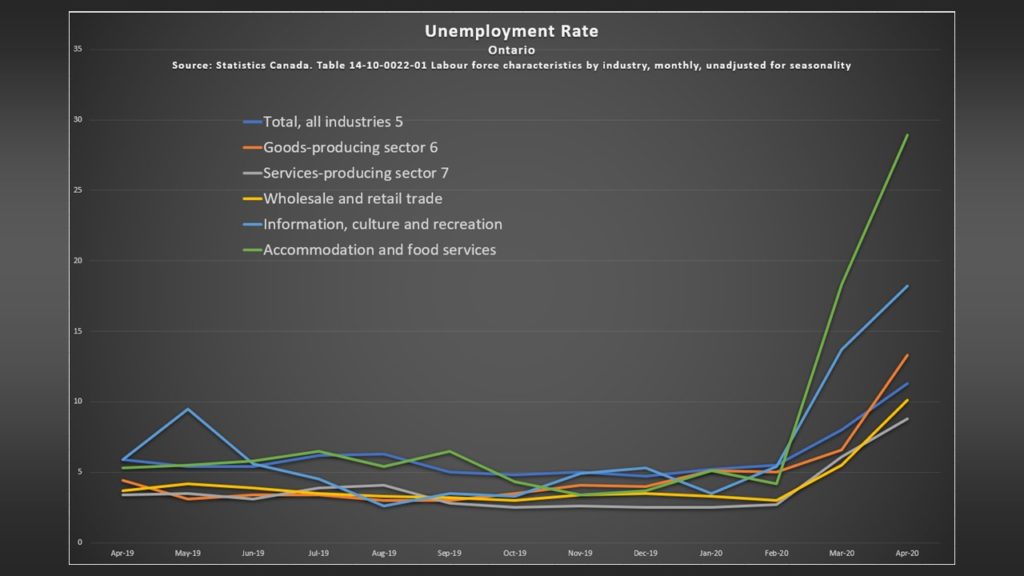

I keep asking myself, how many people is this going to affect? Unemployment figures for the month of April were just released from Stats Canada and they are staggering. 13% unemployment. Check out the chart I created below showing the different industries’ unemployment figures.

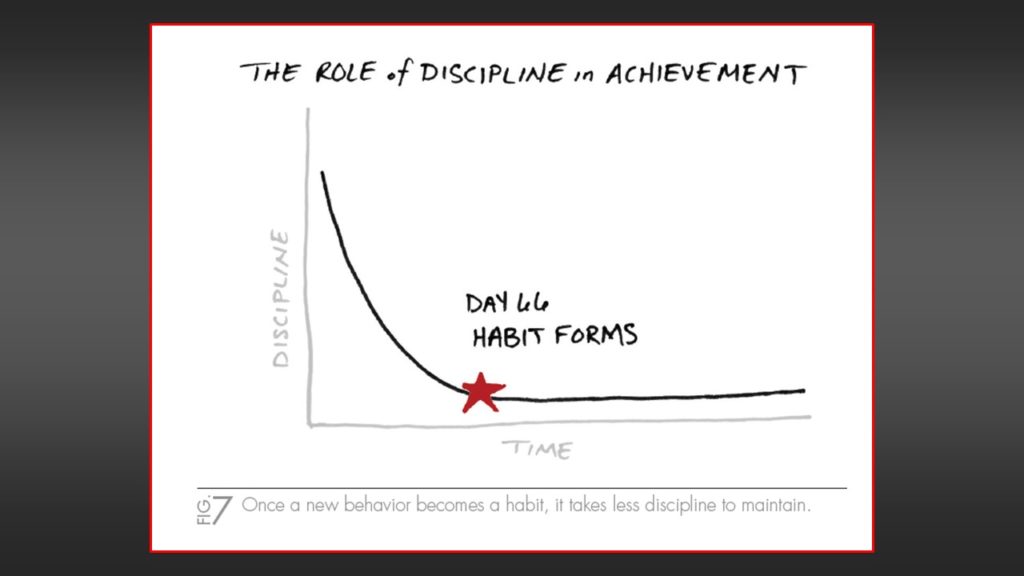

The question now becomes, how many of those currently unemployed will get hired back once the economy picks up? Nobody knows because this has dramatically changed how we live. This lockdown has been long enough to form habits. I remember reading “The One Thing” by Gary Keller. That is a great book by the way, but one of the things Gary talks about is habit forming. It was written that it takes 66 days to form a habit. Well, we have been in lockdown since the middle of March and if I go back 66 days from today (May 12th) that would put us at March 6th.

We have all formed new habits whether we know it or not.

What’s that going to say for certain industries/ employers? Some industries/ employers may be affected more so than others. Long story short, this could have a significant impact on people’s incomes. Notably the accommodation and food service industry and information/culture and recreation as they are in my opinion the most likely industries to be affected on a longer-term basis.

This all comes at a scary time for Canadians as many of us are severely over leveraged with debt. It has been written about that missing 1 paycheque could severely impact one’s ability to pay their bills.

A study conducted by Ipsos (https://www.ipsos.com/en-ca/news-polls/Canadians-and-Bankruptcy-Oct-2019) found that “Nearly Half of Canadians (48%) Are $200 or Less Away from Financial Insolvency”.

Interest rates are already low, the BOC interest rate is currently at .25%, meaning the next possible rate reduction would be zero percent.

What can the Bank of Canada do to stimulate the economy?

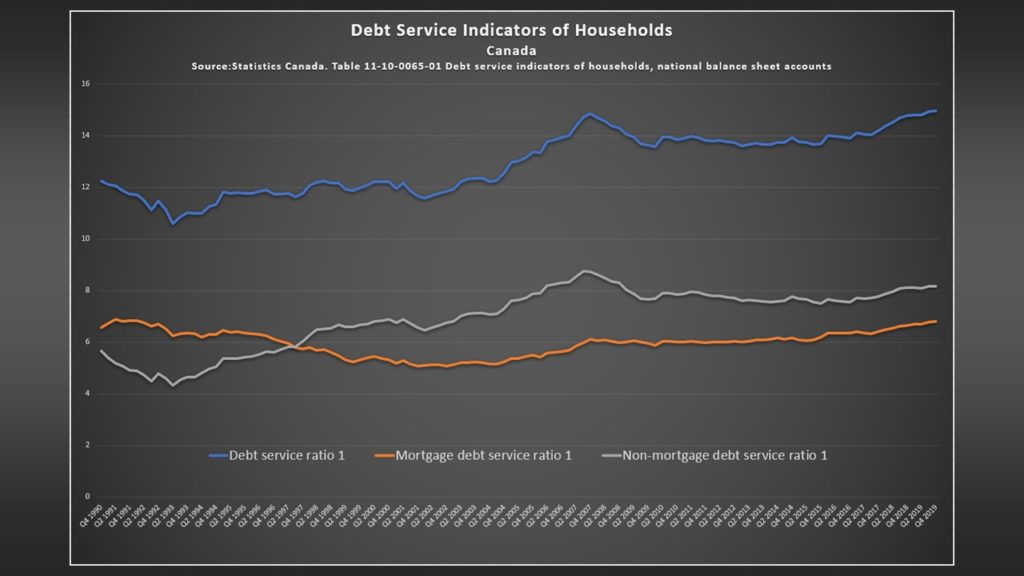

Check out this chart;

Ok, doesn’t seem too crazy right? The two main sources of debt on this chart are mortgage debt and non-mortgage debt.

The scary thing is that HELOC (home equity line of credit) is not included in the mortgage debt, it is included in the non-mortgage debt with car loans, credit cards, furniture loans etc. HELOC loans are still secured against real estate, further increasing the debt burden on our homes.

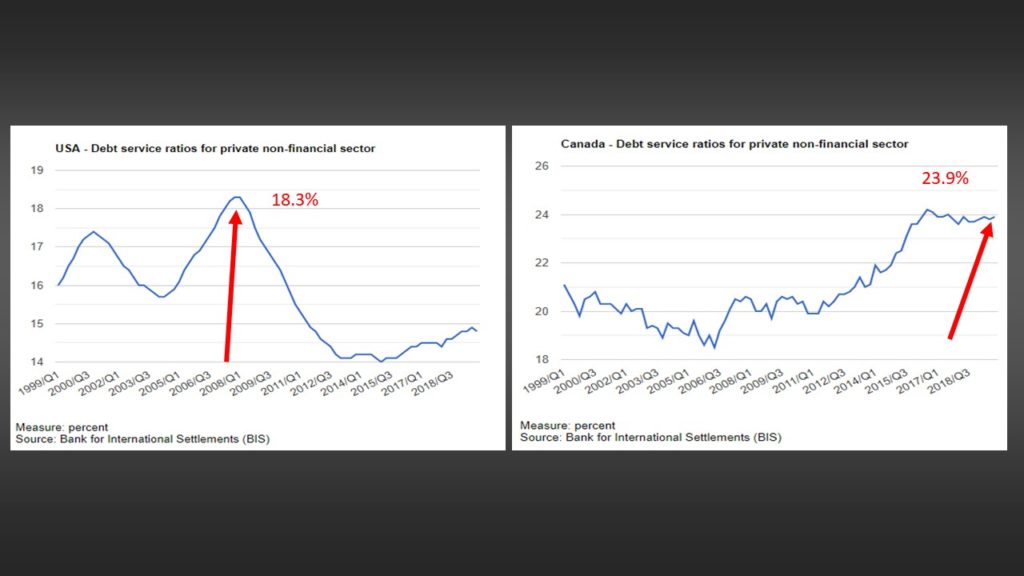

One more thing I would like to point out is a comparison of the Canadian debt service ratio to that of the USA debt service ratio.

Specifically take note of 2008 on the USA chart. At the peak of the financial crisis, USA debt service ratios were 18.3%. Currently in Canada we are at 23.9% as of the fourth quarter of 2019. For those that do not know what the Debt Service ratio is showing us, it is the percentage of our income that we must use to pay our debts.

I don’t like to be pessimistic, for those that know me, they know I am a positive person, but part of me wants to see a market adjustment. The cost of home ownership is getting out of control.

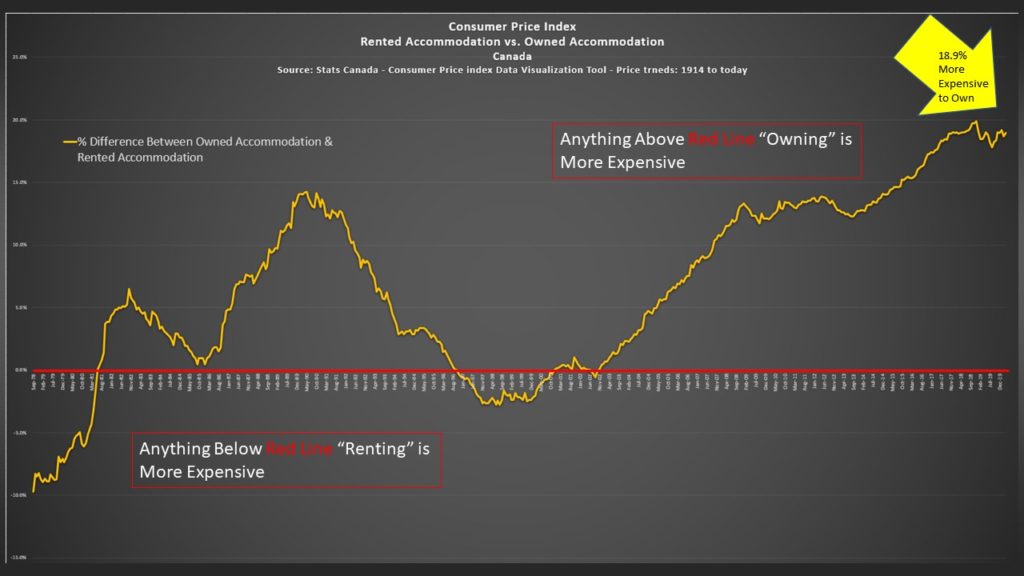

Check out this chart.

This is a chart I created that shows the percentage difference dating back to 1978 between the cost of home ownership, compared to that of rented accommodation. The data was taken from the consumer price index for both values.

Basically, what this is telling us, is that right now, the gap between the cost of renting vs. the cost of home ownership has never been greater, at least going back to 1978 (42 years).

In March of 2020, according to Stats Canada CPI, it was 18.9% more expensive to own a home, compared to renting.

As a real estate investor, it’s become increasingly more difficult to purchase a property through conventional investment strategies (20% down, 25-year amortization) and have that property cash flow. I would often wonder, is it the rents that are low or the sales prices are too high? It’s safe to say that prices are too high.

Real estate prices in the simplest form are generated from supply and demand.

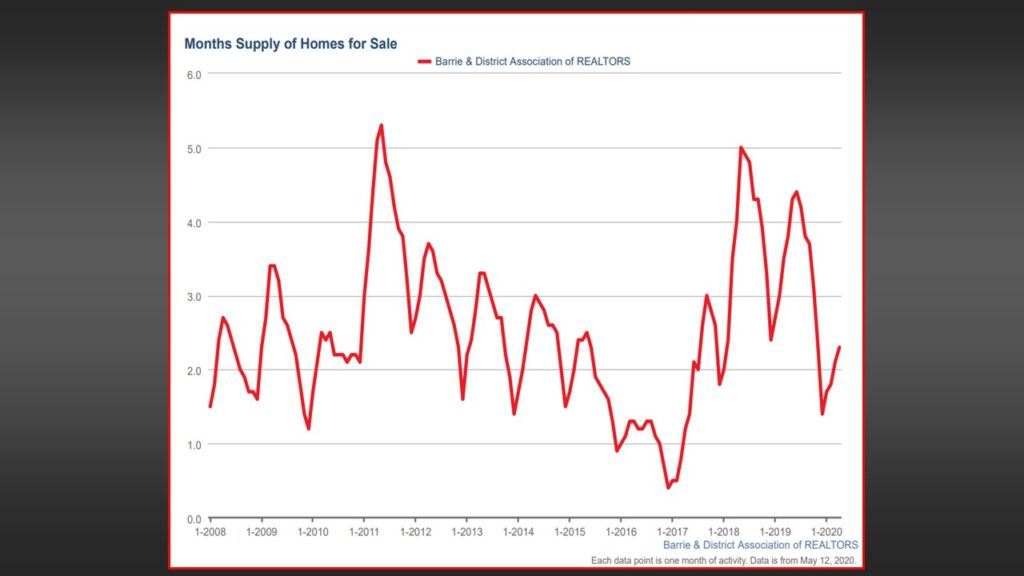

Since I got into real estate as a professional in 2013, the market has been dominated as a seller’s market. Sellers market meaning the supply of homes available on the market is low and there are more buyers than sellers.

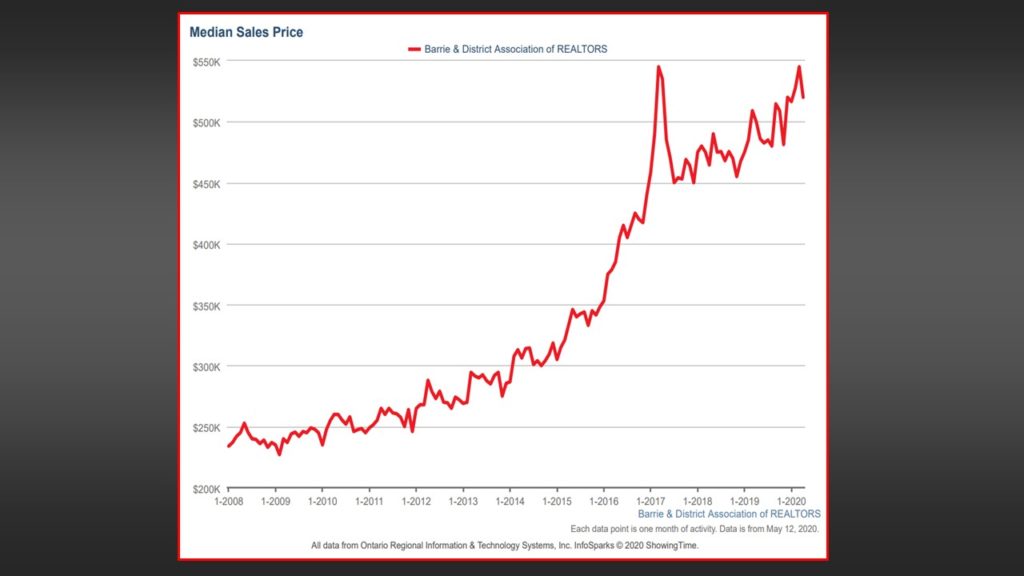

Interest rates have been low, access to money and credit is cheap and people are spending money. Real estate prices were appreciating at very high levels to the point that the government had to step in with a policy change to cool the market in 2017.

Now I will say this, with the market cooling that took place in late 2017/ 2018, that has brought more of a balance to the real estate market in the Barrie and surrounding areas. In late 2019, into early 2020, before the arrival of Covid-19, we started to experience decreasing supply issues, which in turn resulted in increased selling prices.

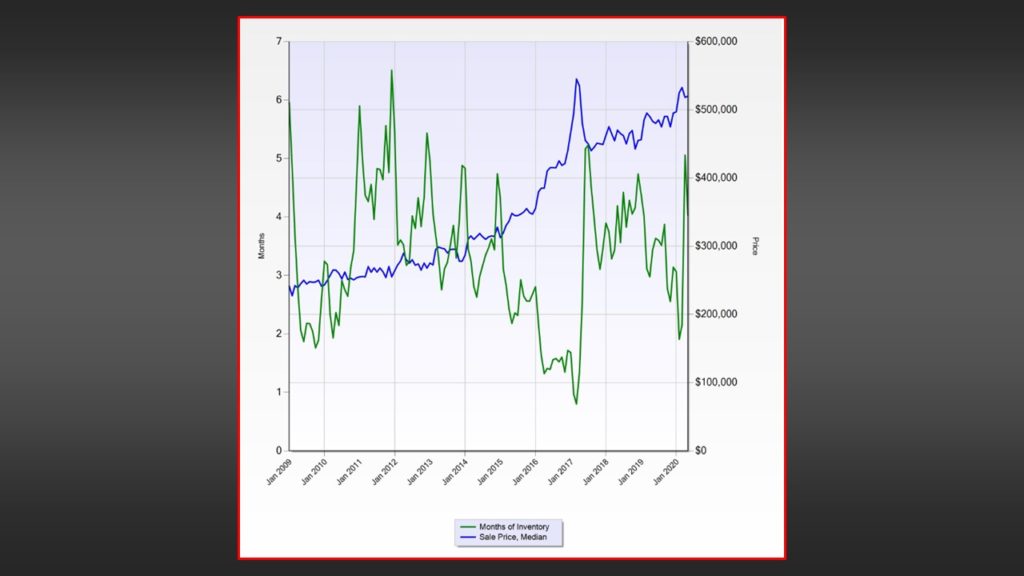

The chart below shows the monthly supply of homes on the MLS real estate market in the Barrie area dating back to 2008. The higher the line goes, the more supply in the market. The lower the line, well you probably figured it out, the lower the supply.

If we were to put the next chart over the previous chart, it would be like looking at a reflection. The correlation between the supply of homes and sales prices is clearly shown here.

With such uncertainty surrounding people’s employment moving forward and employment is what produces the income we need to service our spending and debts; (assuming the government cannot keep paying everyone’s income for the next 12 months) we are surely going to see situations where people are forced to sell their assets.

I also think consumer behaviour will change regarding wanting or needing to buy a home given such uncertainty in the economy. This along with many of the reasons I have outlined earlier, I am quite confident saying that the Barrie and area real estate market will see an increase in the supply of homes listed on the MLS, which in turn will surely result in a decline in home prices.

This is not all doom and gloom, don’t worry. If you are looking at the real estate market with a long-term perspective, I do not believe you have anything to worry about. Prices will most likely decrease in the short term (1-3 years) but in the long term, prices will go back up to where we are now and eventually surpass where we are now. A natural progression that has happened throughout history.

That brings me to the question posed in the title. Do not buy a house in Barrie unless….

If it were me, having researched historic price trends and other research surrounding our current situation, I would NOT buy a house right now UNLESS you are looking at purchasing with a LONG-TERM buyer’s perspective. If you are buying a home you are going to live in for years and years, and you think it’s a good deal (which deals have started popping up), then who cares when you buy! So long as you can service your debt payments and you don’t take on more than you can handle, go for it!

Seize the opportunity if it presents itself and when the time comes for you to sell, now years and years down the road, this little blip in the real estate market will be long behind you.

It simply will not matter.

You will still have made money if you bought the property for a good price because real estate is the greatest hedge against inflation, in my opinion.

If you are in the market looking for a house to flip, b e v e r y c a r e f u l, but if you are looking long term, (family home, long term investment) then keep an eye out as an opportunity worth pouncing on may come up and you might be perfectly situated to take advantage.

If you are buying and selling in the same period of time, (Sell in May, Buy in June), again it does not really matter that much in terms of the risk that prices could decrease. It is all relative. Meaning, regardless if you bought or sold a property right now, either of the situations would see the house price decrease and if it’s in the same period of time the decrease would be the same for both properties. You with me? Haha

If you are you thinking of selling in the short term, it might be wise to consider selling sooner, than later.

Thanks for reading. I welcome questions and constructive dialogue so feel free to reach out, jeff@jeffgilbert.ca.

P.S – If you would like to see my price forecast for the next 5 years, simply complete the form below and I will send you a copy of my real estate price forecast. The model has multiple different scenarios, ranging from HUGE price decrease, modest price decrease, equilibrium, and modest increase. A great resource to refer to if searching for deals!