It is being widely speculated what actions regulators and policy makers may take to cool the housing market of which one of the big talking points seems to be surrounding around changing the required down payment for investment properties and possibly recreational properties as well.

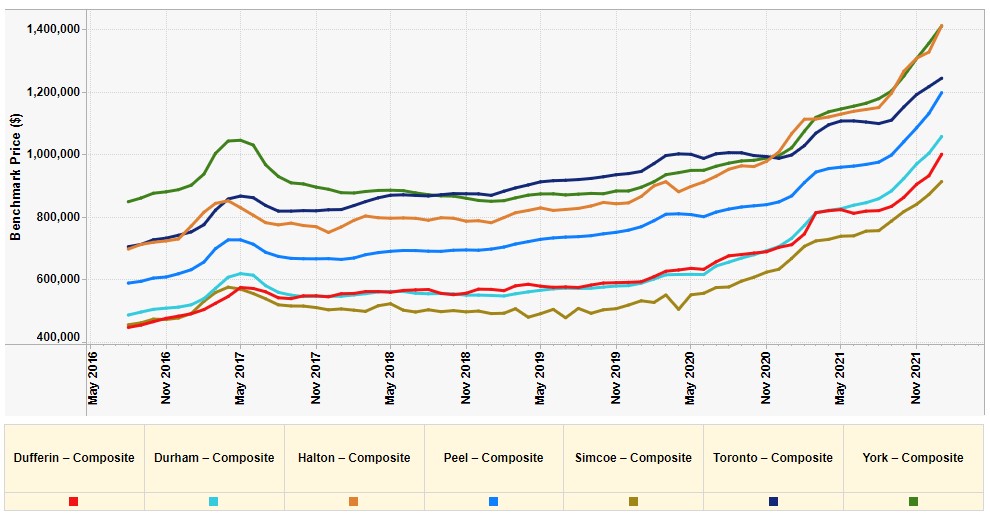

Price growth continues to surge in real estate markets across Ontario and frankly all of Canada. Active listing inventory is at historic lows and demand seems to be at historic highs. This combination has resulted in accelerated price growth across the greater Toronto area and most provinces as well.

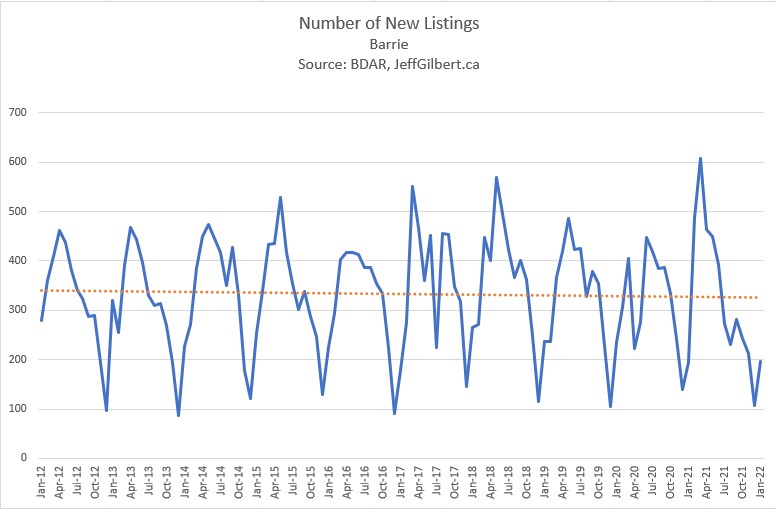

It can be said there is just not enough new listings, and we are not building enough new homes. I would agree that is part of the problem, however looking at market data for my local real estate market, Barrie, it shows that new listings are in fact down, but not down by a substantial amount.

The orange line is trending in a downwards trajectory but when you look at March 2021, the Barrie real estate market saw the highest number of new listings of any month within the past 10 years.

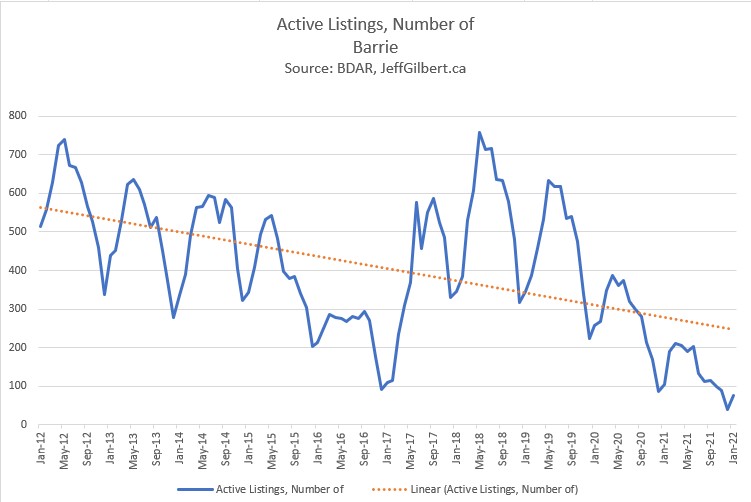

Now let’s look at active listings. This is where we can see the impacts of increased demand in the market. This chart, also taken from the Barrie real estate market shows a significant drop and trajectory of active listings on the market.

The market just cannot sustain any normal level of active listings.

This is where the regulators and policy makers are looking and why it is being widely speculated that we could see a change to the required down payment for investment properties and possibly recreational properties as well.

This article in the Financial Post suggests that CMHC is already looking at this type of policy, https://financialpost.com/real-estate/mortgages/cmhc-to-review-down-payments-on-investment-properties-as-part-of-federal-strategy-to-tackle-housing-risks

What are the proposed/ speculative changes to down payment for investment properties and recreational properties?

It is entirely possible that new regulations would see a required 35% down payment for secondary houses including cottages. This would be an increase of about 15% as currently in most cases you can put down 20% on a rental property or cottage.

Nobody knows when this will come into action or even if it will, the best guess I am seeing would be as early as the springtime, which coupled with a rate hike from the Bank of Canada on March 2nd (the next interest rate announcement) could have a significant impact on the markets. Perhaps a similar impact that we experienced as recently as mid 2017, see the 1st chart for what prices did at that time.

Thank you for reading, click here to learn more about my real estate services.