This article will show you how mortgage rates in 2021 considerably help home owners build more equity than in years past.

Has anyone ever told you that the majority of your mortgage payments that are made in the first few years go towards paying down the interest, with very little actually going towards paying down the principal balance?

If you have heard this, chances are the person saying this knew and perhaps experienced mortgage rates in the 1980’s and 1990’s.

In the 1980’s and 1990’s, higher mortgage rates meant that very little equity was paid off during the first few years of the mortgage.

Low interest rates today mean that a greater share of your first mortgage payments actually go toward paying off the principal balance of your mortgage which means you are building a substantial more amount of equity. Even more so given recent price appreciation.

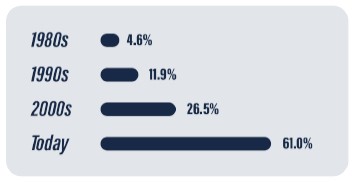

In fact, with current interest rates, 61% of the average homeowner’s very first mortgage payment goes to paying off principal. This compared with just 4.6% in the 1980’s and only 11.9% in the 1990’s.

To put this in perspective:

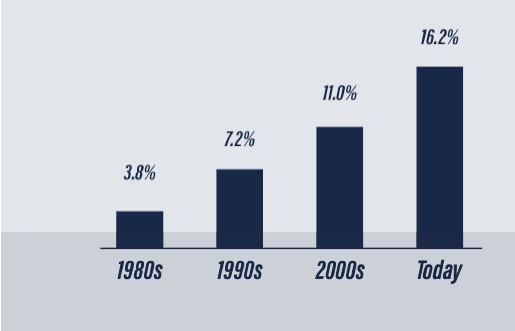

At the end of a standard 5 year term, homeowner’s with mortgages in the 1980’s had paid off just 3.8% of the outstanding mortgage amount (assuming a 25 year amortization).

At today’s low rates, homeowner’s with mortgages pay off 16.2% of their total mortgage in the first 5 years on average.

This means that no matter what happens to house prices, the average homebuyer today will have paid off an unprecedented 16% of their mortgage in just 5 years.

Just another reason why we have seen the real estate market react the way it has during this period of extreme low mortgage rates.

They are an incredible mechanism for building wealth.

Graphs credit to Edge Realty Analytics