If you are following the housing market in central Ontario or really, anywhere in Canada in 2021, you may often hear people citing “Inventory is so low” and they would not be wrong.

What does that mean anyways?

Basically, there is not enough “Active Listings” available in the housing market and because of the lack of supply/inventory prices have been increasing at a very rapid pace. Supply and demand.

So what is the root cause of this lack of supply you might ask?

Is it because of Covid-19 and the fact the on going health crisis is deterring people from listing their properties for sale?

Could be….

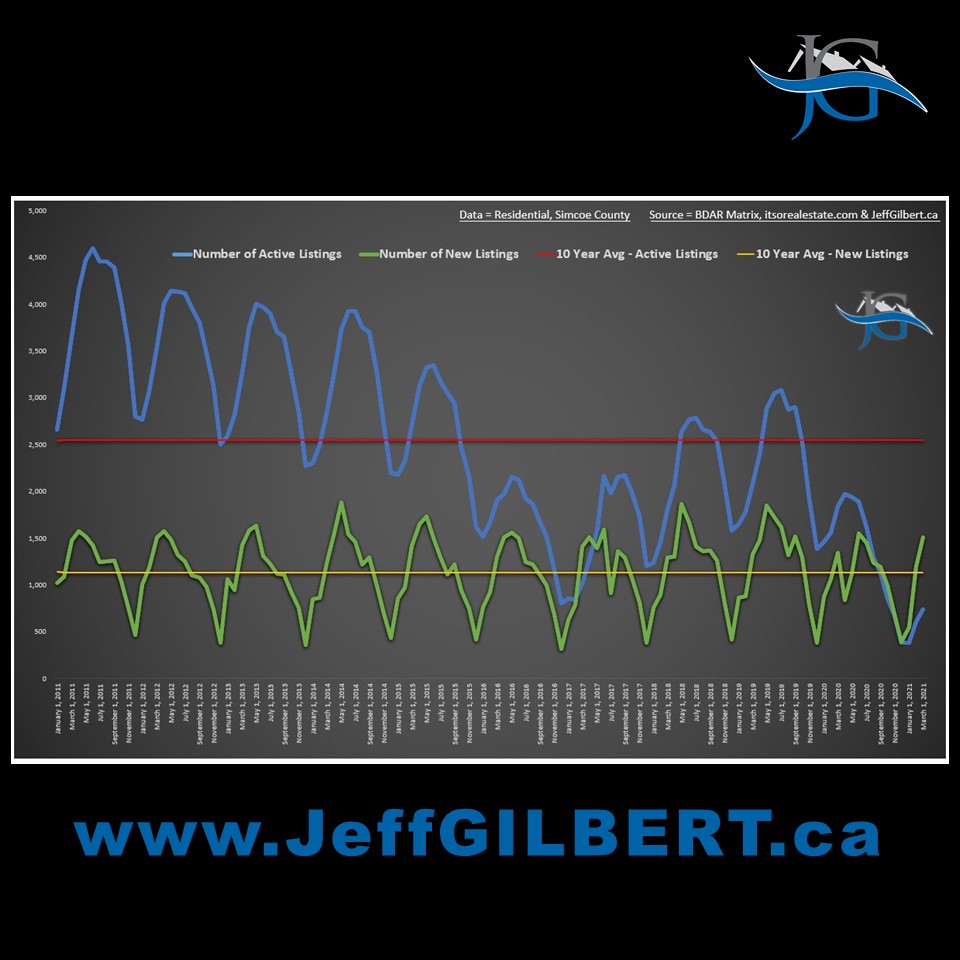

To figure this out, I went and looked at the data for the local housing market that I cover on a day to day basis. This being Simcoe County.

I searched for data in the Simcoe County region, which includes Barrie, Innisfil, Orillia, Oro-Medonte, Springwater, Essa, Midland, Penetanguishene, Wasaga Beach and Collingwood, plus some area’s in between.

What I found is that “New Listings” are actually at normal levels right now, at least when looking at the 10 year average for “New Listings” goes.

Check out this chart:

Simcoe County Residential Data –

Housing Market – 10 Year Period

New Listings, Active Listings, 10 Year Avg-New Listings, 10 Year Avg-Active Listings

You can see that the green line, which represents the number of “New Listings” is above the yellow line, which represents the 10 year average for “New Listings” and it appears to be on track when looking back at data from the past 10 years. This is tells us “New Listings” are actually on a normal trajectory.

Now look at the blue line. This is where we can see some deviations from the 10 year average of the number of “Active Listings”. The blue line is way down there, much lower than what it has been at the past 10 years. The only other time, within the past 10 years anyways, that the number of “Active Listings” was so low, was in late 2016, early 2017, which was the last time central Ontario and Simcoe County (Barrie etc.) experienced very rapid home price appreciation.

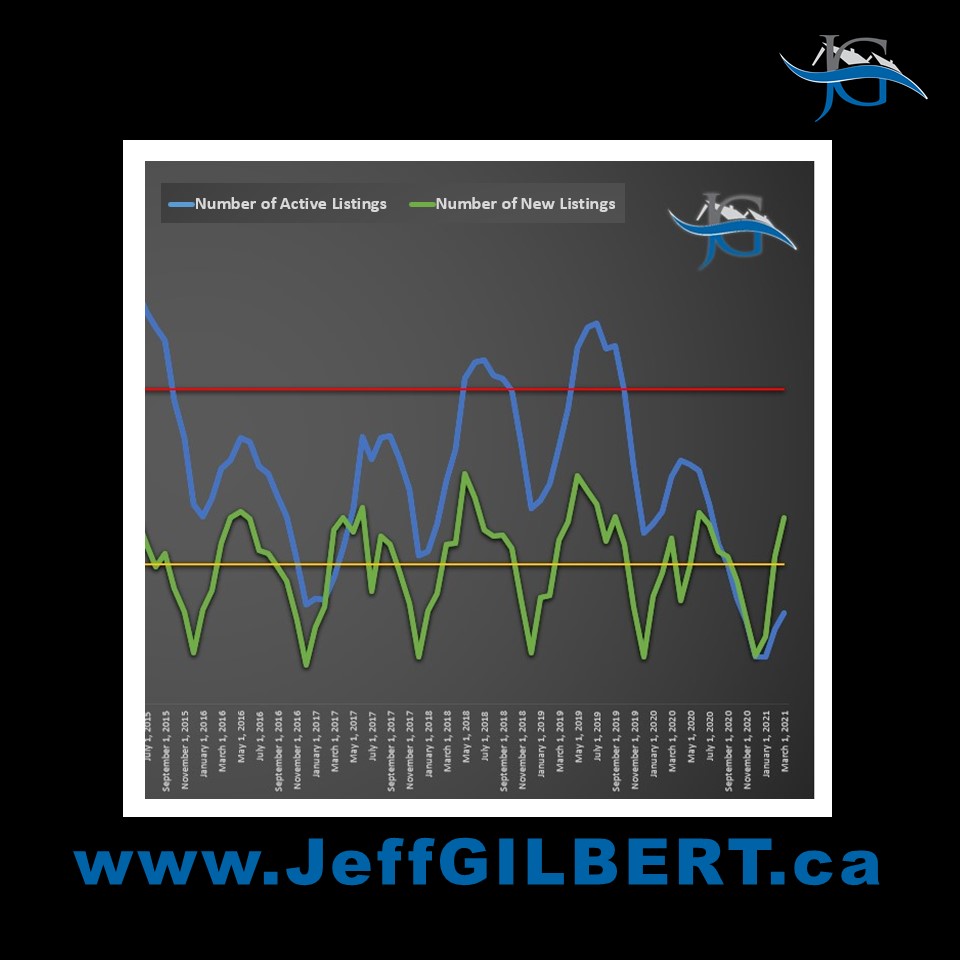

Here is a closer look:

So what does this tell us?

Well, it tells me that demand for real estate is off the charts right now. Any new listings, all be it at normal levels, are quickly sold once listed on the market. This demand has created a new way of selling homes. A way in which sellers and their representative set a list price, usually below actual market value, then instruct everyone that any offers will be entertained on a future date at a specific time. This way the seller can ensure they get as many buyers through their property and then they have the best chance to create a competitive situation with multiple bids. If they did not do this… well, in most cases the seller would have an offer on day 1 or day 2 of being listed and you would eliminate many buyers who had not had the opportunity to even see the property resulting is lower competition and most likely a lower sale price.

Competition and multiple bids has resulted in steadily increasing property values in the housing market.

The last question I will pose today, why such crazy demand for real estate right now? We are in a recession right?

My guess – historically low interest rates. Essentially you can borrow and leverage someone else’s money for less than what the Bank of Canada considers our target inflation rate of 2%.

Until the cost of borrowing increases, one could expect the demand for real estate and overall housing market prices to continue “as is”, but that is anyone’s guess. I was wrong before haha. I can admit it though. 5 Reasons Why You Should Not Buy A House Right Now.

Thank you for reading.

Jeff